Federal withholding per paycheck

The more allowances an employee chooses to claim the less federal tax their employer deducted from their pay. For a hypothetical employee with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Why are these numbers different.

. The changes to the tax law could affect your withholding. How to use a withholding tax table. And 137700 for 2020Your employer must pay 62 for you that doesnt come out of your pay.

The federal income tax withholding from your pay depends on. The calculation for FICA withholding is fairly straightforward. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019.

That result is the tax withholding amount you should aim for when you use this tool in this example 50. Federal income tax withholding was calculated by. That and its an important step when it comes to making sure youre not withholding too much or too little from every paycheck.

This is a credit of up to 500 per qualifying person. However theyre not the only factors. For example if a couple makes just over 100000 a year together that would mean theyd end up owing about 9600 in federal taxes.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Wages paid along with any amounts withheld are reflected on the Form W-2 Wage and Tax Statement the employee receives at the end of the year. How much tax is deducted from a 1000 paycheck.

Simplify Your Day-to-Day With The Best Payroll Services. Instead the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine. 250 and subtract the refund adjust amount from that.

Obviously the specifics will again vary based on individual incomes. IR-2019-178 Get Ready for Taxes. How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form This number is the gross pay per pay period.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.

Withholding allowances were used to determine an employees withholding tax amount on their paychecks. 9 Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000.

How withholding is determined The amount withheld depends on. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

10 12 22 24 32 35 and 37. Tips for Using the Federal Withholding Calculator The Federal Withholding Calculator can. This all depends on whether youre filing as single married jointly or married separately or head of household.

250 minus 200 50. Federal income tax and FICA tax withholding are mandatory so theres no way around them unless your earnings are very low. Why does it say To get your desired refund amount you will need X withheld from each paycheck Y less than your current tax withholding And then it says to Enter Z in additional withholding per pay period Line 4 c on Form W-4 is already pre-filled in the Download button below.

How to Check Your Withholding Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Withholding allowances were exemptions that employees used to use to claim from federal income tax using Form W-4. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay.

The federal withholding tax has seven rates for 2021. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 5 Filing status on W-4 form How to Calculate Your Federal Income Tax Withholdings.

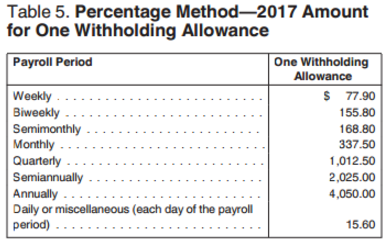

Paycheck Deductions for 1000 Paycheck. An employer generally withholds income tax from their employees paycheck and pays it to the IRS on their behalf. Subtracting the value of allowances allowed for 2017 this is 4050 multiplied by withholding allowances claimed.

In order to adjust your tax withholding you will have to complete a new W-4 form with your employer. 1 You start or stop working 2 Your marital status changes 3 Your number of dependents changes or 4 The amount you want withheld from each paycheck changes. You can ask your employer for a copy of this form or you can obtain it directly from the IRS.

If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. Ad Compare and Find the Best Paycheck Software in the Industry. IR-2019-111 IRS reminds taxpayers to adjust tax withholding to pay the right tax amount.

Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Get ready today to file 2019 federal income. Check Your Tax Withholding Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

The federal withholding tax rate an employee owes depends on their income level and filing status. Then look at your last paychecks tax withholding amount eg.

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Irs New Tax Withholding Tables

Understanding Your Paycheck

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Federal Withholding Tax Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Federal Income Tax

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

How To Calculate 2019 Federal Income Withhold Manually

Calculation Of Federal Employment Taxes Payroll Services

Paycheck Calculator Take Home Pay Calculator

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Take Home Pay Calculator

Calculation Of Federal Employment Taxes Payroll Services